The ES futures contract started the day with multiple counterintuitive trade setups that traders need to be able to recognize.

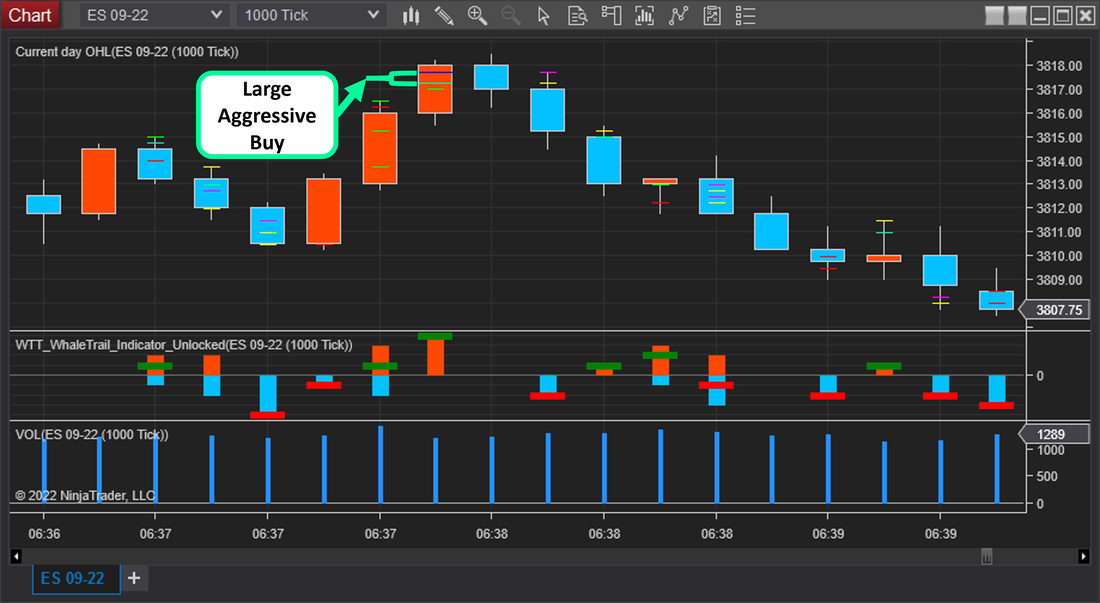

One example took place at 6:37am PT, or about 7 minutes after regular market trading began at 6:30am PT (9:30am ET). After a quick 8-point whipsaw upward for the September ES contract, the Whale Trail Indicator detected a large, aggressive buy. Prior to this large, aggressive buy, the ES contract was already trading above the normal fair value range for ES relative to the S&P 500 cash index value. Then, this Whale stepped in and further pushed the ES contract price outside of this fair value range creating a quick opportunity to short ES and capture a few points of profit until the ES contract fell back into a normal fair value range.

Remember, each point for ES is worth $50 per contract, so this setup could have been a quick and painless $200 profit trade per contract. However, only small Whales were trading for the next couple minutes as the price dropped over 10 points, so staying in this trade a bit longer would have produced great results for this short trade.

This setup begs the question: "Why would a large Whale buy at a price well above fair value, and how can I spot this if I'm not tracking fair value?" The answer is that these types of setups are traps for small traders and executed with algorithmic trading. Just like in the example above, large whipsaws almost always precede these setups. After the large and fast whipsaw up in price, the large trader pushed the price even higher and then started immediately liquidating and reversing into a short position. Given the high liquidity in ES, this trade is relatively easy to pull for an algorithmic trader. Additionally, after a large, aggressive trade smashes through the resting orders in the order book, a 'vacuum' effect is left in the wake of the trade. Since fair value was much lower than the ES price after that Whale trade, less bidders came in to support that high price, which made the price fall that much faster.

These counterintuitive trades are usually what cause new traders to fail, so having the right tools to help detect these setups are essential. Test drive the 'Whale Trail Indicator - Unlocked' version with a Free Trial and see how having the right tool can analyze the order flow, simplify the market, and change your trading performance!

Happy Whale Watching!

One example took place at 6:37am PT, or about 7 minutes after regular market trading began at 6:30am PT (9:30am ET). After a quick 8-point whipsaw upward for the September ES contract, the Whale Trail Indicator detected a large, aggressive buy. Prior to this large, aggressive buy, the ES contract was already trading above the normal fair value range for ES relative to the S&P 500 cash index value. Then, this Whale stepped in and further pushed the ES contract price outside of this fair value range creating a quick opportunity to short ES and capture a few points of profit until the ES contract fell back into a normal fair value range.

Remember, each point for ES is worth $50 per contract, so this setup could have been a quick and painless $200 profit trade per contract. However, only small Whales were trading for the next couple minutes as the price dropped over 10 points, so staying in this trade a bit longer would have produced great results for this short trade.

This setup begs the question: "Why would a large Whale buy at a price well above fair value, and how can I spot this if I'm not tracking fair value?" The answer is that these types of setups are traps for small traders and executed with algorithmic trading. Just like in the example above, large whipsaws almost always precede these setups. After the large and fast whipsaw up in price, the large trader pushed the price even higher and then started immediately liquidating and reversing into a short position. Given the high liquidity in ES, this trade is relatively easy to pull for an algorithmic trader. Additionally, after a large, aggressive trade smashes through the resting orders in the order book, a 'vacuum' effect is left in the wake of the trade. Since fair value was much lower than the ES price after that Whale trade, less bidders came in to support that high price, which made the price fall that much faster.

These counterintuitive trades are usually what cause new traders to fail, so having the right tools to help detect these setups are essential. Test drive the 'Whale Trail Indicator - Unlocked' version with a Free Trial and see how having the right tool can analyze the order flow, simplify the market, and change your trading performance!

Happy Whale Watching!

RSS Feed

RSS Feed